Revenue Recognition in the Life Sciences Industry – ASC 606 Compliance

Reporting of revenue has been a required necessity since the beginning of accounting for business operations. The goal of accounting standards was always to accurately report business operations in a consistent and digestible manner so it can be known by management, investors, the public, or any other relevant stakeholder. To facilitate this, and keep up with changing business models, the standardized rules used can change over time. ASC606 is a recent and comprehensive overhaul of these rules to achieve exactly that goal.

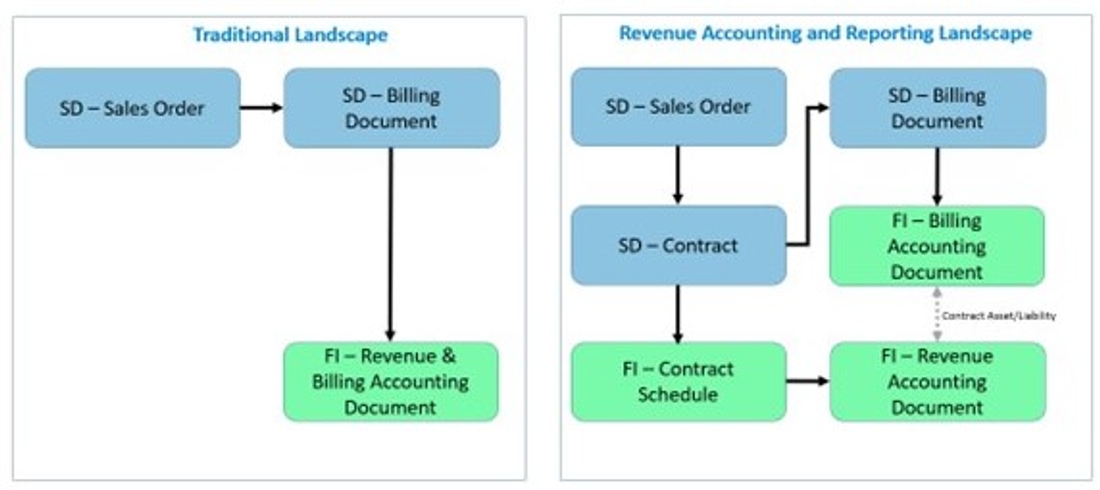

SAP has developed the Revenue Accounting and Recognition (RAR) module to facilitate the new standards.

What is changing with ASC 606 and why

Traditionally, recognizing revenue for GAAP reporting has been a straightforward process: a simple GL Account mapping exercise when setting up an SAP ERP. Revenue was recognized at the time of customer billing, and a simple off setting of the customer account with a revenue account based off a material or customer group is all that was needed.

This was a simple concept to understand: once a customer is billed, you created an asset in the form of an account receivable, which resulted in an offsetting revenue posting. In fact, this process still works for many companies which make or purchase goods to stock and fulfill individual customer orders of products as they are received. However, in the life science industries, customer delivery can be much more complex. Customer delivery is often based on detailed contracts instead of one-off orders. These contracts can have billing schedules completely independent of the business’s delivery obligations.

As a simple example, what if a company was contracted to manufacture 2,000,000 units for the price of $1 each, to be delivered in 2 years, with $500,000 due upfront and $1,500,000 payable only at the end of the 2 years? Traditionally, we would have recognized $500,000 in revenue on day one to match the receivable due (ignoring down payment functionality for simplicity). No work has been done for the customer yet. Instead, an obligation has been created for the business to the customer. The traditional accounting method does not match our business reality. Why should we recognize revenue when we haven’t delivered anything? Furthermore, what if we finished manufacturing all 2,000,000 units by the end of the first year? In that case, we fulfilled our entire obligation from our point of view, and now have a right to expect payment in full. However, since the actual billing can’t contractually occur until the end of the second year, we have no way to recognize this accomplishment with traditional revenue accounting.

The new revenue recognition rules aim to correct this difference between contracted customer billing and economic reality demonstrated in our scenario. In ASC606 we refer to our illustrated accomplished economic reality as our Performance Obligations. Any difference between revenue and billing created by the completion of performance obligations is now recognized as either a contract asset or liability.

ASC 606 takes each individual contract through a 5-step process which the RAR landscape mimics:

Step 1: Identify the contract – It is important to note that all obligations of a contract are treated as a whole and not individually.

Step 2: Identify the performance obligations – This is a listing of the actions the business is to accomplish for the customer and will be a key driver selecting the accounting method.

Step 3: Determine the transaction price – This is the total amount billed to the customer for the entirety of the contract.

Step 4: Allocate the transaction price – In this step we determine the economic reality of each of the performance obligations as opposed to the contracted sales price (transaction price). This is done by taking a total of the would-be stand-alone price of each performance obligation summed together and determining the percentage each performance obligation is of the total. This percentage is the applied to the transaction price.

Formulas:

Stand-alone price of obligation / Total Contract Stand-along price = Performance obligation allocation %

Performance obligation allocation % * Transaction price = Event completion revenue

Step 5: Recognize revenue – Period end recognition of the performance obligations completed and their allocated transaction price as revenue.

Our insights on RAR capabilities

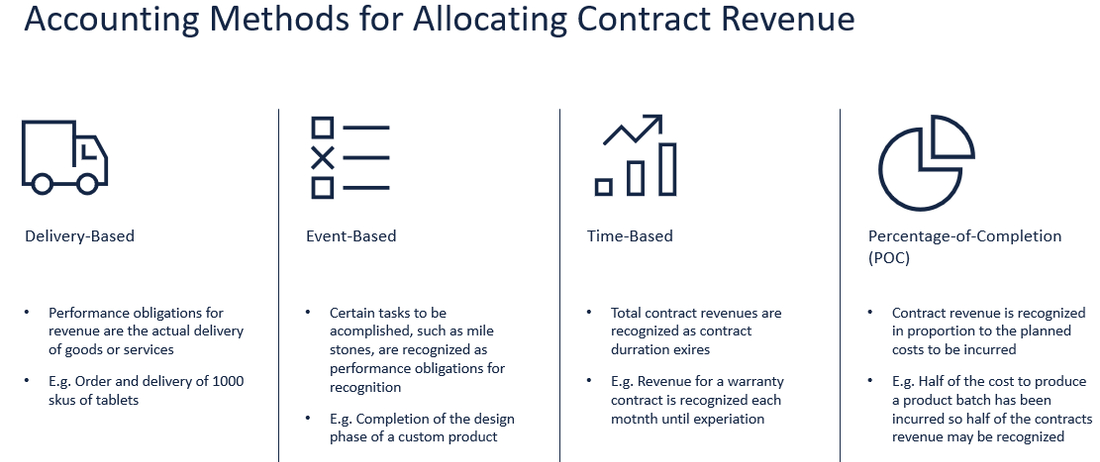

While all contract revenue recognition follows the same 5-step process outlined above, this is just a tool. We must be able to use the toolset in a manner that not only fulfills our compliance requirements but not put limitations on our customer offerings.

To maximize the value of customer offerings, it is important to structure commercial deals in a manner that aligns with customers’ interests and ability to pay. This can change drastically not only specific industry to industry, but even customer to customer. To attract and retain customers, it is critical to not only have a great product and price, the model in which a customer is billed needs also to align with their individual needs.

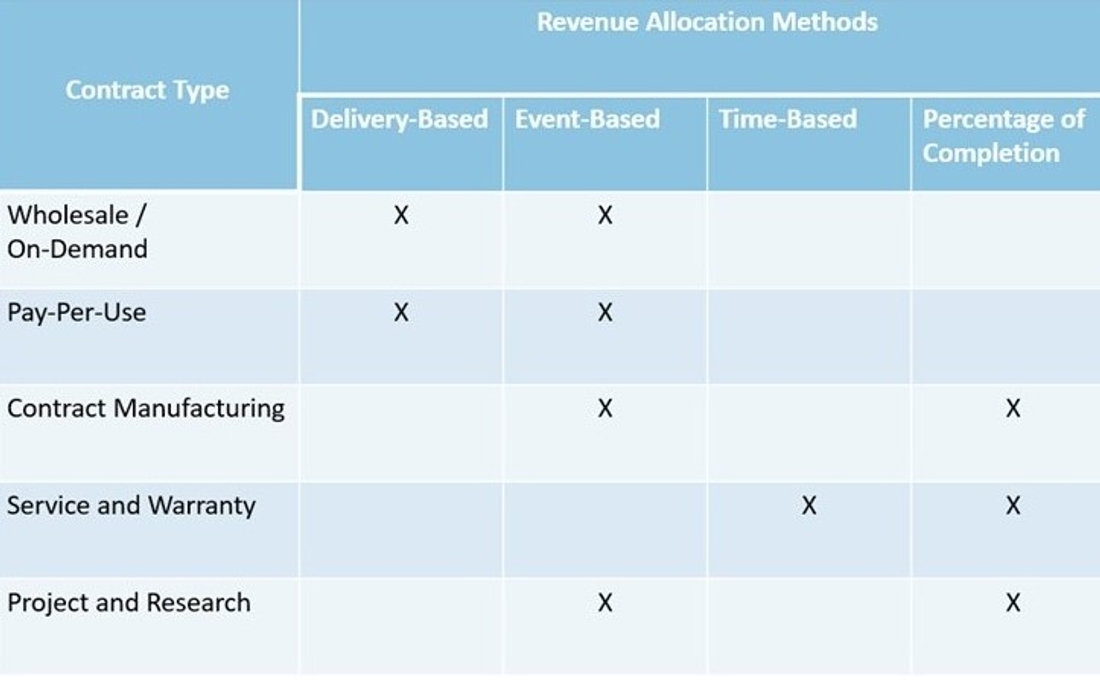

To accomplish this, all applicable revenue allocation models should be determined, including in combinations for complex contracts.

A single company may engage in one or all these industry contract types requiring unique performance obligation identification and revenue allocation. Being able to select and optimize RAR to your specific needs will be critical to providing a scalable solution:

Your RAR solution should be designed with your industry and offerings in mind to create an optimal solution to create customer value and clearly report your company’s economic realities in a scalable manner. Without considering your specific industry and applying a one-size-fits-all model, you will increase accounting and sales department workload and limit your offerings.

Conclusion

ASC 606 customer contract revenue recognition rules have created a new level of complexity and effort for many life science industry businesses. SAP has provided a robust toolset with Revenue Accounting and Reporting (RAR) which will allow for your companies reporting requirements to be met with minimal operational effort. However, the use of RAR is very dynamic and needs to be carefully designed to achieve your organizational goals.

A complete commercial model and accounting method mapping, along with careful design of the RAR solution, will result in your statutory compliance, enhanced management reporting of your operations, commercial flexibility, and a scalable solution.

Please reach out to our Life Sciences Finance and Controlling experts to find out how to simplify and scale your financial reporting needs.

Stay up to date with the latest #Lifeattenthpin #LifeSciences #Pharma #MedDevices #Biotech #Digitalforlife #Thoughtleadership #Medical Technology #AnimalHealth news by following us on Instagram #LifeAtTenthpin Facebook Tenthpin and our Tenthpin LinkedIn corporate page.