Pursuing Excellence in Clinical Supply Management ‒ Topic 3: Planning Excellence

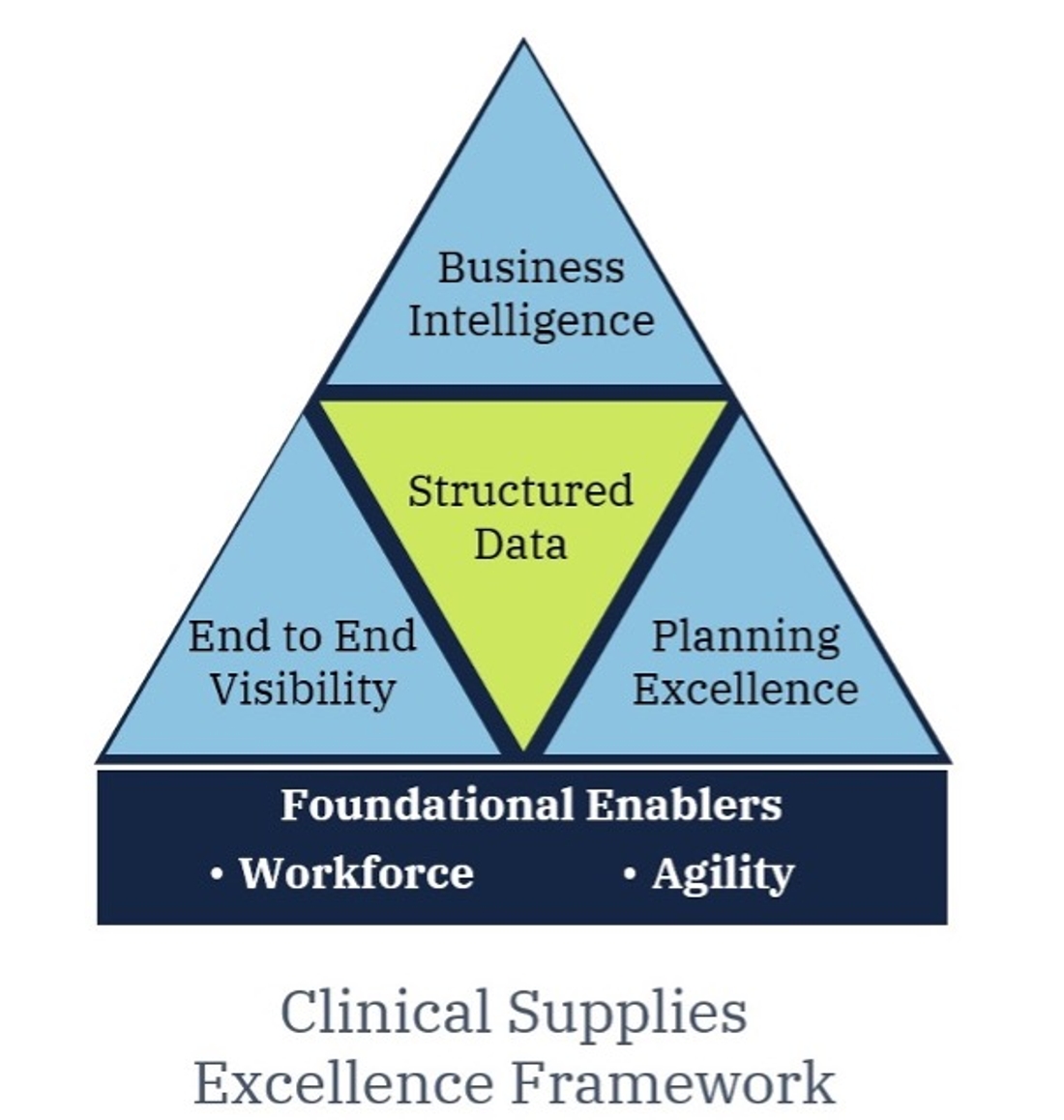

Tenthpin has launched a short series of articles covering aspects of differentiation and excellence for clinical supplies management. These articles are collections of experiences and insights which have come from working with the industry on various initiatives over many years. Previous articles in this series covered excellence in Workforce and Agility, and End to End Visibility. What follows is Article 3: Planning Excellence. A fourth article in this series will examine the operational and strategic capabilities of business intelligence in clinical supplies.

Introduction

Within the industry just about everyone has a gut feeling that clinical supplies planning is a highly important area. Certainly, if the plan is flawed or out of touch with reality it can lead to significant operational and business challenges downstream.

For actual feedback on the importance of planning we cite results from an extensive end-to-end clinical supplies benchmarking effort which was conducted with 14 large and midsize biopharma companies. The results showed that greater maturity and capabilities in planning correlated to greater performance across the entire clinical supplies process.

And, more interestingly, in the benchmark results review sessions with each company, we learned that the organizations who were leaders in clinical supplies planning were not satisfied with their performance in this area and were often investing significantly in approach adjustments and more advanced capabilities.

To understand these two findings, we will first examine aspects of foundational importance to clinical supplies planning excellence and then look at capabilities of next-level planning performance. The article will wrap up by revisiting these two benchmark findings and will offer insights into their implications for the future.

Foundational Excellence in Clinical Supplies Planning

Clinical supplies planning performance excellence should be fundamentally characterized by the accuracy of its plan versus the actual results (notwithstanding the fundamental clinical supplies requirement of meeting all patient needs). While measuring plan accuracy versus actuals would be ideal, the terrain for clinical supplies planning is too diverse across types and complexities of clinical studies, company operating models (insource/outsource is the clearest example here), process maturity and the simple fact that comparing planned versus actual for study supply performance is highly complex, as well as time and data intensive.

Digging a little deeper, examining forecast accuracy/bias data is the optimal way to measure planning performance. The more difficult aspect is looking at the demand forecast accuracy bias compared to the patient enrollment forecast accuracy/bias. This is where it gets difficult because clinical operations rarely put much emphasis on country-level enrollment forecasts – as opposed to clinical supply, which relies heavily on this information.

Let’s accept the limitation of not being able to extrapolate past data and instead look at foundational characteristics of clinical supplies planning excellence:

- Credible inputs

- Process rigor

- More frequent feedback/planning cycles

Credible inputs

There are three highly important inputs into the clinical supply plan; clinical study parameters, operational or predictive changes to these parameters, and the patient enrollment and supply actuals as they occur. A clinical study protocol even when finalized is from a supply chain perspective a projection with major unknowns such as drug stability, dose titrations, and patient behavior (enrollment/dropout) which must be estimated and then extrapolated. This reality makes the clinical supply chain manager’s job challenging and unpredictable as the actual results in most clinical studies are far different from the original ‘final’ plan; a situation that will not change.

With this accepted as the nature of the task at hand, the clinical supply chain manager relies on the upfront accuracy of the initial protocol parameters, and then on updates made at the study level for re-planned values in the protocol (country start dates, patient enrollment projections, amendments to dosing plans, etc.), as well as the actuals occurring during the study execution such as the actual enrollment of patients, inventory levels, and drug stability updates. Gaining these updates in a timely and accurate manner is crucial, yet this is often a very sporadic and inaccurate activity.

How can companies improve their access to credible inputs for clinical supplies planning? From our experience we see the following as foundational capabilities:

- Better upfront participation and alignment to clinical operations decisions and information updates impacting the study supply chain

- Timely processes and automated solutions for the accurate update of actual data into the clinical supply planning algorithms

The bottom line: A plan can only be as accurate as its inputs. Not having key information in a timely and accurate manner leads to lower visibility and lower confidence in the plan. As the overriding clinical supply goal is patient drug supply at the ‘right time, right place, and right quantity’, this lower visibility and accuracy then drives a greater need for supply chain contingency resulting in greater buffering of inventory, missed opportunities for efficiency/savings, and poorer overall supply chain results.

Process rigor

As clinical studies can be highly individualistic, so too can the process for planning them. The process in practice at most organizations is more art than science with the process typically varied per clinical supply chain manager. Factors in this variation are lack of standards and lack of clarity and documentation on the process. Minimal rigor would be having a clear process and guidelines for the planning activities and not simply a timeline of expectations to a requested periodic result. It is here that some have fallen into the trap of saying ‘but every molecule study is different’ and/or ‘there is no one right way to plan’.

How can companies improve their process consistency and accuracy? Here is what we see as the foundational capabilities:

- Consistent planning process and tool execution, and consistency per the identification of actions needed to correct / adjust the current supply chain execution plan

- Documented tolerance expectations leading to clarity on what constitutes a good plan

- Control of the clinicals supplies process execution

- Fair expectations and rigor agreed with contributary organizations

- Ability to monitor and report progress on the planning process execution

- Formally employing management by exception concepts

More frequent feedback/planning cycles

As a general observation, we find that companies with lagging clinical supply planning capabilities often have longer re-planning cycles. For most companies, the cycle of re-planning their study clinical trial supply plans are monthly and for some quarterly. The longer the frequency of re-planning, the closer the planning process reflects a ‘set it and forget it’ situation.

Why is monthly the most common timeframe? This is primarily for two reasons: it corresponds with the monthly commercial supply chain rhythm as well as the standard order cycle for outsourced packaging and distribution. A second reason is that most companies do not have automated actuals feedback capabilities, so it allows enough time for the clinical supply chain manager to manually gather and represent the information into a snapshot for their re-plan.

Leaders in clinical supplies planning can re-plan weekly and on demand as needed (often for cases deviating from the supply chain rules). In these organizations, the clinical supply chain manager spends more time on value-added work as their work week consists of reviewing their studies re-calculated plans and then taking action to achieve needed adjustments in supply chain execution. Surprisingly, having more frequent planning runs increases planner productivity. Said more directly, companies in weekly mode use less clinical supply chain managers than those in monthly mode per the same number of studies. It should be noted that this is highly correlated with the capability of the planning system and its automation of actuals capture.

Shorter planning cycles produces more accurate plans simply by allowing the clinical supply chain manager to evaluate the plan versus actuals more often. Foundational capabilities for this are:

- Weekly (or less) rhythm of actual updates

- Automated planning runs (on demand as needed)

- Consistent use of leading planning toolsets

Talented and enabled planners

Within the benchmark group, we found only limited outsourcing of clinical supplies planning. These companies recognized that owning the planning process and results was crucial to their overall clinical supply chain performance. What would be some reasons that outsourcing of clinical supplies planning is used? Most often we hear that the intention is temporary and due to limited resource availability or skills in complex planning solutions – a situation where companies pay for both the planning tool and a service. These temporary situations can linger through inaction or conflicting priorities and end up becoming longer term.

Ideally, clinical supply chain managers are experienced and operate in a collaborative team atmosphere. In most drug sponsors, there are senior clinical supply planning resources along with more junior resources. Senior resources typically are those which are entrusted with the highest priority and most complex clinical studies to plan. They also serve as leads to the junior resources and guide them in their activities along with providing valuable judgment for supply chain decisions.

These decisions and the follow through supply chain actions are the measurable outcome of clinical supplies planning. This is the all-important empowered human factor. Foundational capabilities for this are:

- Core of deeply talented and professional senior leaders in the planning group

- Action oriented culture with clear accountabilities

- Measurement of performance results at the study level

- Training and enablement program to progress new joiners into junior clinical supply chain managers able to contribute directly in under three months

In summary: These four foundational characteristics together will drive top quadrant performance in clinical supplies planning. But at this level, we have found that satisfaction in planning capabilities and clinical supply chain results is fleeting and drives leaders to desire next-level differentiated performance. Let’s look at some of those capabilities now.

Achieving Next-Level Planning Performance

Innovation and continual application of advanced capabilities requires supportive, patient, and strategically oriented management as leading-edge thinking and investments have both risks and upsides. Below we list some advanced or leading approaches and capabilities that some in the industry are pursuing:

- Process segmentation

- Data intelligence

- Performance management

- Program level planning

Process segmentation

Over the past two years, we have seen that segmentation as a strategy is picking up steam. High-priority clinical studies are those that are more important due to the potential of the drug under clinical trial investigation, the sheer size and cost of the study, and the operations risk of the study. Why not treat these studies with more attention and have available options to mitigate challenges?

Segmentation is typically a differing approach for select studies throughout the clinical supply chain. Within the clinical supplies planning process, this could mean differing planning approaches such as simulations or the greater use of scenario planning, or increasing the re-planning cadence, or including specific clinical supply management assessment targets.

Data intelligence

Clinical supplies planning is by nature a study-by-study activity with set inputs and individual planner assignment, in essence a closed loop. What outside data could better inform this process and lead to better understanding either predictive or interpretive of current results?

Leading companies are deploying tools and processes to analyze prior clinical trial performance data in the areas of patient enrollment, clinical site performance levels, and supply chain planning and execution performance to better predict current clinical study patterns. Another example is the use of dashboards for visualizing key study supply performance parameters such as projected waste, depot days of finished drug supply, or viewing patient enrollment actuals to plan to inform the health of the clinical study supply chain and even suggest corrective actions. In these examples, the challenge is typically in the collection of accurate data across multiple sources and ensuring flexibility for future data-dependent use cases.

Performance management

One management challenge is understanding current performance as well as post-study performance in their clinical supply chain. We have witnessed benchmarking answers to lead times and percentage requests too often end up in round number answers. Many factors contribute to this state, the biggest of which is the difficulty of collecting the data, and not specifically allocating resources to lead in this area. Most companies are of course collecting metrics, but the process is time intensive, and the metrics captured are rather limited and mostly historical in nature.

Leaders in this area have a far better grasp of their data because they have centralized it either into their core application or through using a structured data repository. Once the data is centralized into one source of truth, these companies have access to information for viewing current performance, seeing issues (current, interpretive, and predictive), as well as the ability to perform ad hoc queries into the data.

Program level planning

The increasing cost of clinical drugs and their comparators is driving increased interest and actions toward program level planning, inventory pooling, and on demand pack / label operations. These both rely on aggregation of study level planning and execution data into program level data. Having this data as part of the planning process enables greater flexibility across studies and is a key input into inventory postponement decisions. The current state among many of the leaders is that this level of aggregation is primarily available in reports only, and thus not directly part of the process. Gaining this visibility will lead to a better understanding of supply chain opportunities which when accompanied by process changes can lower both costs and supply risks.

Conclusion

Reflecting on the original points that clinical supplies planning performance is a leading indicator for overall performance in clinical supplies execution, and that leaders are more aware of their improvement needs and have more innovative ideas for further improvements – is this still a little surprising?

No, not really. This is pointing to a situation where leaders, once they have the foundation in place for planning excellence, look for further areas to leverage their position and flexibility for advantages in efficiency and more importantly further improved business results for greater speed and flexibility for the overall drug development effort. Clearly clinical supplies planning will continue to be a challenging area and also one with high returns for improvements.

For further details please reach out to Tenthpin Experts Partner Dan Silva , Advisor Felipe Pereira and Advisor Chris Yuen

Click here to read Pursuing Excellence in Clinical Supply Management – Topic 1: Workforce and Agility.

Click here to read Pursuing Excellence in Clinical Supply Management – Topic 2: End to End Visibility.

Stay up to date with the latest #Lifeattenthpin #LifeSciences #Pharma #MedDevices #Biotech #Digitalforlife #Thoughtleadership #Medical Technology #AnimalHealth news by following us on Instagram #LifeAtTenthpin Facebook Tenthpin and our Tenthpin LinkedIn corporate page.