Leveraging divisional financial reporting in S/4HANA

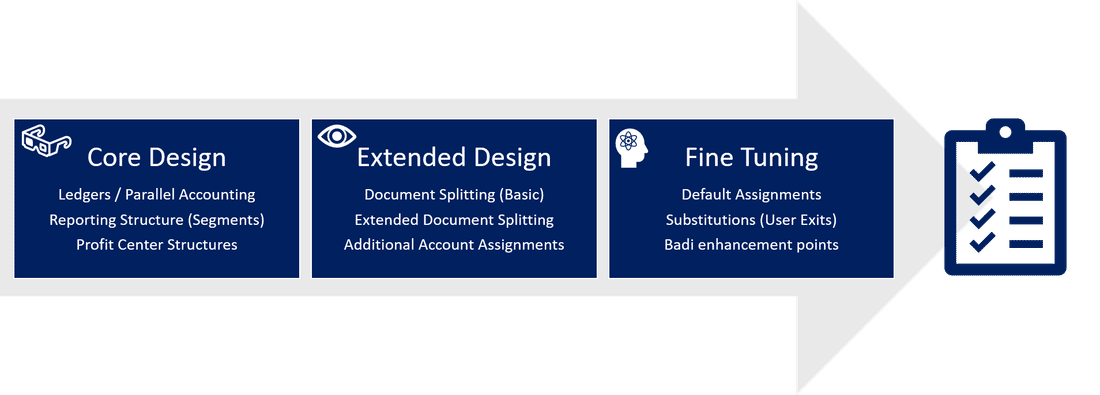

Core Design (Segments/Profit Centers/Document Splitting/Parallel Accounting)

New General Ledger functionality includes Document Splitting, Segmental Reporting, Parallel Ledgers, and Valuations. Whether upgrading in ECC from Classic General Ledger to New General Ledger, upgrading to S/4HANA in a brownfield implementation, or performing a greenfield implementation, the journey to the final financial accounting should never be considered a technical upgrade but as an opportunity to perform an overhaul on how the company’s financial statements are produced.

Parallel Accounting

In General Ledger Accounting, parallel accounting is used to run several parallel ledgers (general ledgers) for different accounting principles (e.g., IFRS and local GAAP). During posting, you can post data to all ledgers, to a specific selection of ledgers, or to a single ledger.

Segmental Reporting

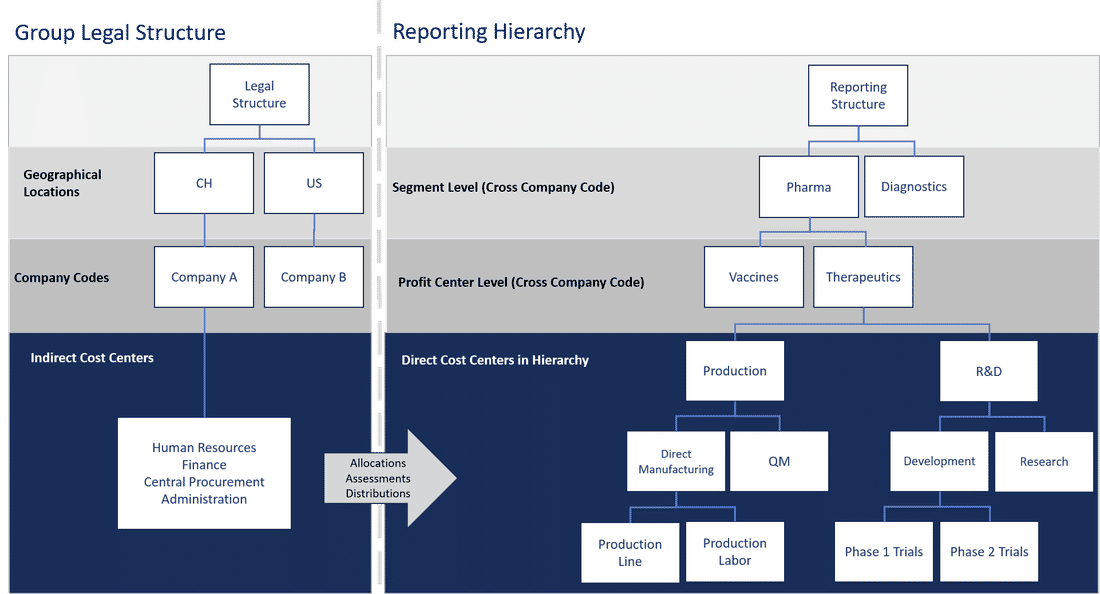

A segment can be used according to the business’s reporting needs and can reflect a product/product line and/or a geographical region. If we take a common approach example where each geographical region is represented by way of legal entity, the focus is then moved to a management accounting viewpoint. With S/4HANA, we understand that the core master data elements have now been incorporated into the S4 General Ledger (Segment and Profit Centre Accounting) which allows us to post both to the correct legal entity and adopt the segmental approach. The below diagram illustrates the postings both to legal entity and how the postings sit within the reporting structure to provide the required financial statements (Legal view and a view for the segment, in this case, the Pharmaceuticals Segment).

So, in structure definition, we bear in mind that the legal entity reporting is focused on the Company Code(s) within a Country, whereas the reporting level includes the cross-company code objects Profit Centre the Segments to which they roll up to. This then enables the production of the financial statements in a matrix format regardless of the legal entity or geographical location (although the geographical location can indeed form part of the segmental design if desired). It is also worth noting that the functionality is applicable for company codes including a production element where indirect costs can be allocated by a traditional method (assessments and distributions) to provide a more accurate view of the profitability of the segment. The nature of companies A and B in the diagram is for illustrative purposes only rather than an association with direct/indirect postings.

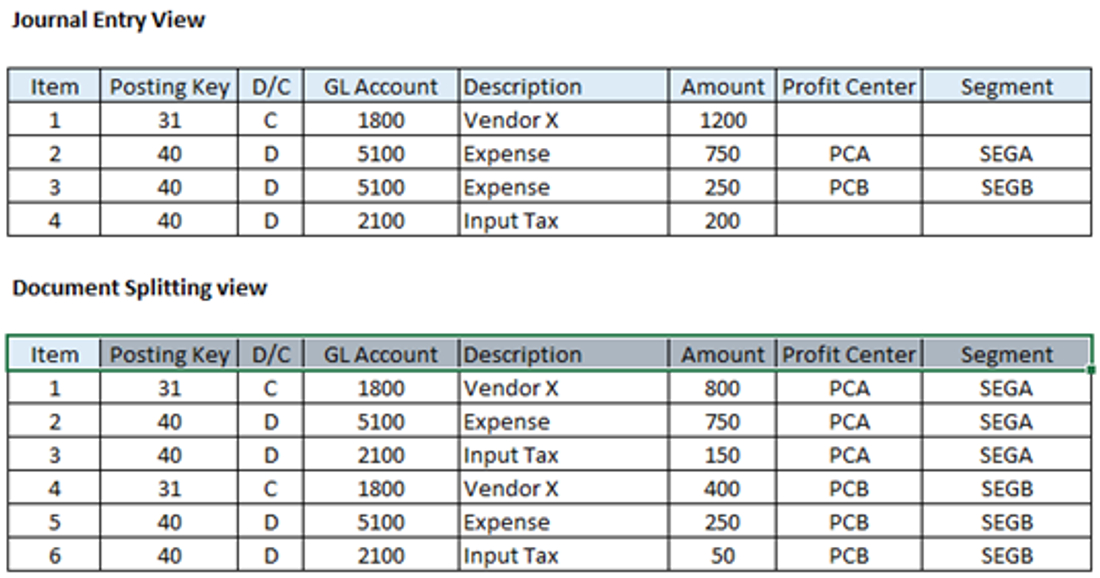

Document splitting can be used to ensure that most entries are correctly posting to relevant segmental balance sheets and P&L Accounts. S4 also offers the possibility of a zero-balancing option, where one (or multiple) zero balancing accounts can be set up to capture and lines cannot be determined by the characteristics and, in some cases (such as payroll postings) to make a summarised entry. In my view, the zero-balancing option can be very useful for completeness depending on reporting requirements, although as it does act primarily as a balance sheet prepayment/accrual, depending on relevance, further consideration should be given to identify the nature of these items as described below.

Document Splitting (extended)

Where items are not able to be classified and posted by the standard configuration of document splitting, we are able to create Document Splitting Methods and Rules for the client to add granularity at a line-item level and ensure that all postings are on the appropriate GL Accounts. This step is performed during the design phase of the implementation.

With the new S/4HANA functionality, complete segment, and profit center, improving financial reporting should be an objective within any S/4HANA implementation or upgrade.

Tenthpin is here to assist in the transformation process. Please do not hesitate to contact us if you wish to discuss this further.

Stay up to date with the latest #Lifeattenthpin #LifeSciences #Pharma #MedDevices #Biotech #Digitalforlife #Thoughtleadership #Medical Technology #AnimalHealth news by following us on Instagram #LifeAtTenthpin Facebook Tenthpin and our Tenthpin LinkedIn corporate page.